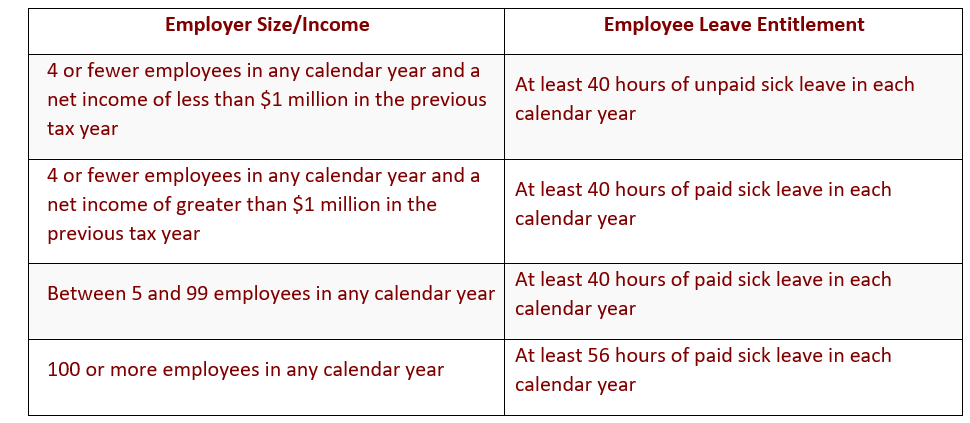

BUT if you want to talk about WandaVision, I am THERE. (You are all spared the original version of this post, that compared the FFCRA to The Vision and California’s legislature to Wanda Maximoff and the Labor Commissioner to Agent Woo. On a related note, California’s Labor Commissioner is a total go-getter and already published the model notice for the California rule. There was no renewal of the EFMLA time – if exhausted, the employee is not entitled to more. That means, the employee has a new bank of 80 hours of qualifying paid sick leave (and paid sick leave for which the employer can get the payroll tax credit). Of note, if an employee took FFCRA paid sick leave already, their bank of time is renewed as of April 1, 2021. In fact, these new reasons apply to the paid sick leave component of the FFCRA and the FFCRA’s EFMLA benefit. The employee is seeking or awaiting the results of a COVID-19 test when the employee has been exposed to COVID-19 or the employer has requested the test. The employee is recovering from any injury, disability, illness, or condition related to the COVID-19 vaccine.ģ. The employee is receiving a COVID-19 vaccine.Ģ. In addition to this welcome assistance, the revived FFCRA has expanded the reasons employees can take FFCRA leave (effective April 1, 2021):ġ. If the reason for the sick leave qualified under the definitions in the FFCRA and the new California COVID Paid Sick Leave, the employer may designate it as both and take the tax credit. The text of the new California law does not prohibit an employer from using the FFCRA to help offset these costs. The employer must fund this benefit without assistance from the state. I suggest you take advantage of this opportunity! California’s COVID Paid Sick Leave is a directive from California to employers to provide paid sick leave. This is important considering California’s new Paid Sick Leave requirement that I discuss in my prior post.

Right off the bat, you should note that the payroll tax credits continue. Now the FFCRA has been modified and extended to September 30, 2021. Then, Employers could offer it through Maand still get the payroll tax credit. As you may recall, the FFCRA expired at the end of 2020. here is some more information about how it interacts with the “revived” FFCRA.

California sick leave law 2021 update#

As an update to my article, below, about the new California COVID Paid Sick Leave.

0 kommentar(er)

0 kommentar(er)